Here’s a glimpse of what you’ll learn:

- [3:43] Vicki Hall reflects on the growth of women’s sports and the Caitlin Clark effect

- [10:25] What it takes to become an elite athlete and the discipline behind it

- [14:05] How sports discipline translates into success in coaching and finance

- [17:44] The challenge of motivating people in business and sports

- [23:05] Importance of relationships and networking in sports and the corporate world

- [27:03] Vicki’s personal financial awakening after her father’s death

- [30:30] The power of compounding and the risk of inflation eroding savings

- [43:53] Why understanding personal spending habits is key to retirement planning

In this episode…

Leaving behind a career in professional sports can be both liberating and daunting, especially when it comes to managing long-term financial stability. Many athletes transition from structured training and clear goals to a world of unfamiliar decisions about money, investments, and planning for the future. How can former athletes redefine success off the court and secure their financial future with confidence?

Vicki Hall, a former pro basketball player and now a seasoned wealth management advisor, shares how she repurposed the same discipline that made her an elite athlete to build financial strength. Vicki explains how losing her father led her to understand the risks of financial dependence and inspired her to master the world of investments, compounding, and strategic planning. She demonstrates how understanding retirement accounts and inflation can help athletes — especially those who may have handed off financial decisions — to take the lead with clarity and confidence.

In this episode of the Proof Point podcast, Stacie Porter Bilger interviews Vicki Hall, Senior Financial Advisor at C.H. Douglas & Gray Wealth Management, on life after professional sports and building financial futures. Vicki shares her personal story of financial awakening, how athletic principles apply to wealth management, and why knowledge is key. She also dives into empowering women, creating personalized game plans, and educating the next generation of leaders.

Resources mentioned in this episode:

- Stacie Porter Bilger on LinkedIn

- Proof Digital

- Vicki Hall on LinkedIn

- C.H. Douglas & Gray Wealth Management

- Leaders Eat Last: Why Some Teams Pull Together and Others Don’t by Simon Sinek

- Maven Space

- Leslie Bailey on LinkedIn

- BlackRock

- Indiana Women Leaders

Quotable Moments:

- “You have to have talent. What do you do with the gift that you’ve gotten?”

- “It’s not how hard you get hit, but how hard you can get hit and get back up.”

- “People are hired because of who they know, not necessarily what they know.”

- “If it sounds too good to be true, it probably is.”

- “Time is actually money. When your time is up, your time is up.”

Action Steps:

- Develop a consistent financial game plan: Just like in sports, a solid strategy provides clarity and direction for long-term success. Knowing your financial goals and how to reach them ensures you stay focused and avoid reactive decisions.

- Understand your spending habits: Gaining awareness of how much you spend helps determine what you’ll actually need for retirement. Everyone’s number is different, and financial security depends on accurately assessing your lifestyle.

- Invest in financial education: Learning the basics — like the difference between stocks and bonds or Roth versus traditional IRAs — empowers smarter decision-making. Knowledge reduces vulnerability to bad advice and builds lasting confidence.

- Start early and harness compounding: Saving and investing while young maximizes the power of compound interest over time. Even small contributions can grow significantly, helping you build wealth with less effort later.

- Surround yourself with trusted advisors: Time is money, and working with professionals can help you make more informed, effective decisions. A good advisor acts as a partner, helping you stay accountable and focused on your goals.

Sponsor for this episode…

This episode is brought to you by Proof Digital.

We are a strategic and creative performance marketing agency partnering with organizations to create data-fueled marketing engines that drive growth and deliver a tangible ROI.

Founded by Stacie Porter Bilger in 2012, Proof Digital employs a strategic marketing approach by blending today’s marketing tools like SEO, PPC, and paid social ads with traditional sales funnel processes.

Ready to get results? Visit https://proofdigital.com/ to learn more.

Transcription – Life After Pro Sports: Building Financial Futures

(0:00 – 0:12)

Welcome to the Proof Point Podcast where we decode digital success one click at a time. We share key takeaways fueled by data and insights that your team can implement today to drive growth. Now let’s get started.

(0:21 – 0:42)

This is Stacie Porter Bilger, your host for the Proof Point Podcast, where I feature B2B and D2C businesses and thought leaders sharing marketing, data tactics and sales strategies and leadership insights that will kickstart your growth in this rapidly changing digital space. This episode is brought to you by Proof Digital. Proof Digital is a strategic and creative performance marketing agency.

(0:45 – 1:01)

We partner with companies to create data fueled marketing sales funnels and overall growth strategies. Visit Proof Digital to learn more. Well I’m really excited to have our guest today. It’s bringing back some memories. I knew our guest back in high school. I unfortunately had to guard her and she was always taking me to school every time.

(1:07 – 1:27)

So our guest today is Vicki Hall. Vicki was an assistant coach for the Indiana Fever and now a wealth management advisor at CH Douglas and Gray specializing in asset management and financial planning. Vicki holds multiple licenses and her background includes a distinguished basketball career and that’s an understatement.

(1:30 – 1:42)

She was named Naismith and Gatorade National Player of the Year in 1988 and played professionally in the WNBA, ABL and overseas for over 16 years and coached in the NBA for years as well. Vicki, thanks for joining. I really appreciate it.

(1:46 – 1:54)

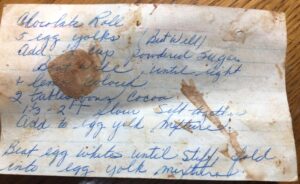

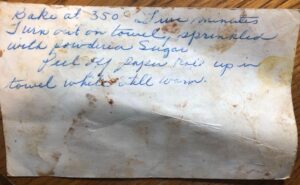

Well awesome. Thank you so much for having me. How fun. Let’s go. This is gonna be fun. Let’s go. Okay I’m gonna start. I’m gonna start with the box that I got from my mom a couple months ago. This is kind of fun right of back to back in 88.

(2:01 – 2:14)

I was a basketball player like I mentioned and I had to guard you and we got killed every time we played for Buff. But this is a magazine that was in a box that I got from my mom who clipped all my things and right there on the front page is you on the on Hoosier basketball. This was the 87-88 version.

(2:20 – 2:34)

I am in this magazine. I’m on page 141 if anybody cares to think so. She’s on front page and I’m on 141. But this is a this is fun. We’re gonna go down some memory lane and then talk about leadership. Talk about women in sports and just talk about some good things about how we can all help one another and grow.

(2:40 – 3:00)

Absolutely. We have to in this day and age. We do and having these conversations and and I am gonna focus a little bit on women women’s sports and women’s basketball just because it is we’re taping Wednesday before the final four and Vicki you played for for Texas and they’re in the final four and they haven’t been in the final four in a long time.

(3:08 – 3:23)

2003 and I think they won in 86 a couple years before. That’s the only national championship so far. They’ve had and they also had an undefeated season that year but so it’s kind of fun for you to see the circle. Yeah I’m gonna be going out there. I leave tomorrow actually so to meet with some clients and see some friends and yeah.

(3:28 – 3:53)

Yeah I bet you I bet you yeah but you still get excitement from that. What you know you saw and we did too. We’re title nine babies and how do you what’s your observation of the growth of women’s sports in general and especially women’s basketball? Well first of all you know this was the 50th anniversary for women’s basketball high school.

(3:59 – 4:20)

That’s crazy. That’s right. Yeah Jane Calhoun who she played at Purdue and we’ve known each other for years and she’s a part of the IHSAA. She actually put some together for us and I didn’t realize how really close and fortunate you know we were to have sports for us. I know. You know because still they they had it in basketball but they didn’t in soccer and all because I didn’t play on the boys team and they wouldn’t give me a uniform.

(4:25 – 4:57)

I mean all kind of crazy stupid things but yeah to meet the first team in from 1976 and you know that group and then just to see that it really wasn’t that far away from when we were and how far they came from the beginning where we were and then where it is now. You know it’s really grown a lot and and what Caitlin Clark has done for women’s basketball you know you can’t ever know there you can’t you can’t put a number on it. I mean it’s crazy.

(5:05 – 5:35)

No, you can’t. And I’m a Fever—I’ve got my ticket, seasonholder, have been on and off between kids and things for that for several years now. But it is the money that she has bringing in to the city. To be truthful, when I go to the game and I go to the bars, they love a Fever game because it’s bringing in outside people to the city, not just your local traffic to these restaurants and hotels and those things. So her impact—and she’s exciting to watch—and she’s bringing attention to other players who are just as exciting to watch. And so bringing that eye to all the players is fun for me to see either.

(5:47 – 6:46)

Although, when we played, Vicki, there were a couple places that when we played, sold out. Burbuff was one of them—not a big gym. Rushville, Noblesville—oh yeah—they had the same kind of feel, to be truthful, when we played. So it’s kind of fun to see that it’s kind of even elevated to a whole another level where people are enjoying sports.

And like you said, I played other sports, and they weren’t quite as visible. So softball was not quite as visible as basketball was. Golf, soccer—well, I’m not sure if we even had a soccer team. And we were a big school! For sure not a girl’s soccer team, right? Right. It was the boys’ soccer team.

But yeah, that’s one of the reasons why I went to Texas—because they were the first university to have separate men’s and women’s athletic departments. And Texas was number one in attendance—they averaged 10,000 fans a game. That’s back in ’89.

So, right, I was like, “Wow, this is a no-brainer. That’s where I want to go.” I mean, I decided between Texas and Tennessee, which—you know—I loved Pat and Iowa, because I loved Vivian Stringer too. But I just chose Texas just because—I mean—they had such a following, and it was just so electric to be there.

(6:46 – 7:39)

And so, you know, being a coach for the Fever in the kind of the lean years, right? And you know, barely having maybe 3,000 fans in the stands—to now, as I’m a scout for the Lynx—and you know, it’s sold out or close to—that’s amazing. That’s amazing.

And, you know, I give credit to the Fever, because you know, when we went in during the lean years, they had us practicing at crazy places and playing at different crazy places. But now with Caitlin Clark, I think they’re bringing in the revenue where they’re actually putting it back into it. And so that’s good.

It is. It is. It’s unfortunate—I mean, it took us that long. Because you know, you gotta invest in things like marketing. You have to invest in marketing. And it doesn’t always come.

(7:39 – 8:23)

Now, that’s kind of a little reverse in women’s sports, where they brought all the money in first, and then now they’re investing. But, you know, at least we’re investing. So I think it’s great.

And I am a big fan mom of a soccer player, so it’s just so fun to see women leaders and get the deserve—you know, get the deserving attention that they should have anyway. Absolutely.

Um, well, when you were playing, is there any particular memorable games or seasons that stand out to you?

(8:34 – 9:21)

Um, well, you know, if you go to high school, you know it was always—we lost in the regional—who would eventually was the state champion. Because we didn’t have five champions; there was just one.

That’s right. That’s right. And you were a small school, to be truthful. I mean, right? School was what—I don’t know if you’re A—I think not even a hundred people in our class. Right.

And you know, we played Noblesville, and it was the Courtney Cox. And yes, he gave us grief. They beat us two years in a row. And Warren Central—before, there was Linda. Got it. Got me. Yep. Yeah, she played Auburn. Auburn.

(9:21 – 10:01)

Yeah, and so those games were always, you know, sold out in the regionals and were electric. So that—for high school.

Probably for college was when we played, you know, Tennessee, or when we went to the Elite Eight. Those were always fun.

And then probably for USA Basketball was when we won a world championship in 1990. That was pretty awesome.

That’s an amazing experience. You’ve seen a lot of places. Basketball took you to a lot of places.

Oh yeah—over 30 countries from basketball that I’ve either lived in or visited or, you know—I didn’t get to see a whole lot of it. Saw the gym. But it was fun to go experience that.

(10:01 – 10:59)

Yeah, for sure.

Now talk a little bit—because I was talking to you earlier—about what it takes to be an elite athlete. I don’t think everybody understands that.

I mean, I was a good—like I said—I was a good ballplayer, but I wasn’t great.

And so you were great—and more than great—because you were the top player coming out of high school in 1988 in the country.

So how do you get to that? Being that elite?

You know, one is God-given talent. You have to have talent. You do. And not everybody gets that.

And then, what do you do with the gift that you’ve gotten?

And, you know, I worked tremendously hard. I was in the gym every day at 6 a.m. before school. They—I got the key to the gym at Burbuff, and I trained. Take a shower, go to class.

At lunchtime—we had a college schedule, so we could move our schedule around—I had a block that I would have out, and I would go and play pickup at the Y. Go back, take a shower, go back to class, and then have practice at night.

And then go home and study—because I still, you know, I came from a family that was very—they were educators and PhDs. And so I better get my studies on.

(10:59 – 12:12)

So it was just, you know, it was relentless. And it was just in pursuit of perfection.

And yeah—it kind of drove me. I mean, it would—it would just—that’s what drove me, was just to be as good as I could be. That is a rare trait, to be truthful, I think. I mean, not everybody has that kind of drive.

I would agree with that. I would agree with that. Especially, you know, after playing, it was kind of eye-opening for me when I went into coaching. Because I kind of figured everybody looked at it like that.

You know—why wouldn’t you want to be the best you can be? Even if you have a scholarship in college, you know, let’s get in the gym and work it out. You know, let’s do it. And it’s just—it’s really—it’s hard to find. Very hard to find.

(12:19 – 12:59)

And like I said, I was, I probably practiced golf the most of all my sports, but I still play, and that’s kind of nice to be able to. But I had a, my dad was a pretty big influence, and I know yours was as well, and we have a similar story with that. But I had a jump rope next to the back of the door, and if I didn’t use it, my dad would know, and he would get off, and it would make him so mad that I didn’t. You know, because he knew that was a way for me to get agility and whatever. But he, I would say, I’m good. He goes, well, you know, I do this or I do that. He goes, well, you’re not everybody else. And so I still was not everybody else, but I still never elevated it to your level. Maybe I was too enjoying too many things or whatever. But it’s a rare trait to focus on one particular skill set and try to drive it to be perfection.

(13:00 – 13:39)

I remember guarding you. Your shot was perfect. So, well, thanks. I spent a lot of time on it. You did argue the perfect thing, but yes, I spent tons of hours. You know, I had a regiment that I had. I had to make 300 jumpers a day — make them. I believe it, yeah. And so, but you know, that led me to have a career of where, you know, I shot about 63% for my career from the floor from two and 47 or 48 from three. I mean, but I put in…

(13:40 – 14:12)

Wow. It is, and it’s like with anything. You know, you have that 10,000-hour, you know, the people use. It’s all about reps, no matter what you’re doing. It’s all about reps. Absolutely. So that’s a good lesson for me, and I’ll get the jump rope out, and maybe I’ll… but you know, it’s carried over. It’s carried over to everything in life. It carried over to coaching. It’s carried over to now the finance world for me.

(14:13 – 14:54)

Yeah, you know, it just — it is. Sports, it’s amazing. Like, it helps you learn how to focus and really, you know, be determined. Because whenever, you know, you’re gonna fail, and it’s how you — it’s always, you know, it’s Rocky. You know, it’s not how hard you get hit, but it’s how hard you can get hit and get back up. Yes. You know, that determination and resiliency, I guess, is another word. If you even look at women who rise up in the corporate world or start a company, most of them played sport.

(14:55 – 15:30)

Yeah, I mean, and part of that is because of that work ethic that you have to have. The determination. How to lose and get back up. I was good, and we had good softball teams. But in basketball, boy, I had to get up a lot. Because when the God B was no longer there, a lot of other teams — I’m 5’9″, and I might have been the tallest. And so, not — you know, we had some things. But anyway, those are really good points.

(15:31 – 16:10)

And I think, how about coaching? How did it — how did these traits kind of — you were a player. I mean, and it’s hard to go from giving up your shoes, or your boots, or whatever, your basketball shoes. Because that was your life for — yeah, it was a long time. Yeah, that was probably the second most difficult thing I’ve done in my life beside losing my father. It was when it was that last day to play. Because playing just brought a whole different kind of joy and feeling than anything else.

(16:11 – 17:18)

And you know, it took time. And, you know, it took time. And I don’t know if I ever really still understand that. Because there’s so many people that had so much more God-given talent than me, even, that I was coaching — like at the WNBA level. I was like, oh my God. I mean, if you just get in the gym with me for like a half hour a day, like we’ll work on this and you’ll be an all-star.

(17:19 – 17:41)

You know, and it’s just hard to do. It is. And it’s got to come with — I mean, like it came within you — it’s got to come in. Their heart has to want it. You can’t change that. You had the God-given talent, and some people can go far with that. But you really have to have a whole other level of want and intention.

(17:42 – 18:15)

So how do you motivate people who — I mean, as a coach — when they’re not there? That’s a hard one. It is. But, you know, it’s the same for all us business people. It is. How do you motivate your employees, you know, to get the jobs done and to do what’s necessary where, you know, your boss feels comfortable delegating? You know, I mean, it’s the same thing.

(18:16 – 18:54)

And, you know, I guess one of the things that I’ve learned — I wish that in some ways that I could have taken some of the courses I did in corporate America as a sports person. Because they take a little different angle, and it makes you think a little differently. And so, you know, it’s just more about connection. And it’s also, you know — like Simon Sinek, I don’t know…

(18:55 – 19:30)

Yeah, yeah, yeah. Leaders Eat Last. Yeah, yeah. Love Simon. Uh-huh. Really, really just trying to understand the people you’re with and what it is that’s important to them. But, you know, it has to be genuine. It does. You know, it has to be genuine. It does. They have to have an interest to grow themselves. I mean, they have to have — you know — wanting to improve. They also have to have that where they take ownership of things. And it’s the same.

(19:31 – 20:04)

What are some of those courses that you think that you’ve taken recently that kind of sparked, you know, some thoughts? Can you think of any? You know, I just — I just go to a lot of different — I was actually — Leslie Bailey, she’s the owner of Maven Space. Yeah, yeah, yeah. I know of her. I know of her. I don’t know her, but I know of her.

(20:05 – 20:38)

She does a great job. And she’s right here in Indianapolis. She did a great job on a couple of different seminars and just talking about, you know, whether it be your elevator pitch or, you know, how to figure out who to hire. You know, just different things like that. You know, there’s so many people that have so many different ideas and thoughts.

(20:39 – 21:06)

And those from her, you know, I’ve learned some things. And then just some other things, like through, you know, BlackRock or, you know, financial — right, right. You know, I think back of — I give this analogy to my team a lot. I was on a good softball team, and everybody on the team was different. I mean, they’re all different personalities, but everybody understood their role.

(21:07 – 21:38)

And you trusted that they would do that role. Whether it was, you know, the pitcher — or I was a catcher — or they were the outfielder, you had trust that they would take care of it. They would do it. So we were able to come together. I mean, I don’t think it’s hard to have that magic that I was able to experience. And, you know, it’s fun for me now that I build teams and build the team to see where their strengths are so that they can, you know, play that role.

(21:39 – 22:00)

Because when that happens, it’s just so fun. It’s magic. And when those teams go to those levels — and those teams right now who are in the Final Four — they probably have that. You know, I actually was just also — yeah, absolutely, you’re right. I was actually also at a — there was a networking event at the Columbia Club and the guy that was he was one of the top people in Cummins.

(21:23 – 21:44)

Okay, they’re a team building. He did a seminar for us, and he just had some interesting things, and how to build a team, and how to build on success, and you know, the different things that it took. You know, I’m just—I’m a student of life, and I like to just learn, you know, wherever and whenever, and you never know when it’s gonna be applicable or not, so you may as well just sit down and listen.

(21:45 – 22:22)

Absolutely, absolutely. I—you know, maybe it’s also from our time and when we were, you know, kids in high school. You know, your dad passed at that time. Mine did too—very similar age—and I have a whole new view of life earlier than, I think, and appreciate certain things. So I think that always learning, always being open to, you know, people’s challenges and growing is part of—something that I think I learned from that era of my life too.

(22:23 – 22:48)

So yeah, and you just—you never know when your last day is gonna be, or somebody around you, and so try to take advantage of, you know, every opportunity you can, and it’ll go a long way.

(22:49 – 22:59)

It will. And in having conversations like this, I just totally—I love because it’s just about building relationships and living today and learning today.

(23:00 – 23:18)

What are—what are any other reflections that you have from sports, before we kind of jump into maybe helping folks with their numbers? You know, it taught me about—so relationships are so important. It’s more important than actually what you do or how you do it.

(23:19 – 23:45)

And you know, it can be taken in a negative context or in a positive context. It’s how you’re gonna take it. But it really is true—you know, people are hired because of who they know, not necessarily what they know. And you know, where that could be—you know, that could be positive or negative. You know, there’s two ways to look at that.

(23:46 – 24:15)

But it really shows that, you know—and you don’t want to just be in and have relationships because, oh my gosh, I’ve got to do this to get a great job or—right? But I mean, that’s a great thing about sport, is the court was the equalizer. And it—and you didn’t really have to—you know, you stepped on the court, and you did your thing. You had your teammates, and you worked together, and we worked as a team.

(24:16 – 24:31)

But it was a great equalizer. It was—where when you step out into corporate America, the equalizer is a lot less. It’s harder to make that distinction from talent.

(24:32 – 24:47)

I think that’s a good point. Is there—what is—are there downfalls or good—or upsides to that, from your perspective?

(24:48 – 25:23)

Well, I wish—I wish personally that I was better with the relationship part of it, being a player. Yeah, because I was so used to kind of just being able to do what I could do, right? That I didn’t realize the importance of it. And then now, as I’ve grown, and now I’m on teams—whether it was I was coaching in basketball, or now I’m on a team at CH Douglas—it’s how delicate, fragile, but important relationships are.

(25:24 – 25:43)

Yeah, you’re so—you’re so right. I’m trying to be more intentional through this podcast, or just going to events. I, frankly, am an introvert. You wouldn’t know that, actually. And so, you know, that does drain me, but it also gives me energy too, so I balance that. But I know that I can make a bigger impact the more relationships I have.

(25:44 – 26:12)

So I think it is—but it’s a little murky out there. You don’t know—you don’t know, like, it’s positive and negative. You got to figure it out. You’re just rolling the dice. And you know what? You just have to have faith that what’s best and what’s meant to be will come.

You know, if you point—if you have that outlook on life, if you have more of a positive outlook that you’re bringing to your life, I think you’re gonna get more positive back.

(26:13 – 26:52)

Yeah. No, absolutely. Absolutely.

Let’s jump in a little bit to kind of give some tips. By the way, you’re speaking April 24th at the Central Indiana Women’s Conference, and you’re gonna really kind of dive in to help, at this particular conference, women really start thinking differently and elevate their game when it comes to money, which is—sometimes we’re a little behind the, you know, the eight ball on that. And I think we need to up our game. So I’m excited about you helping a couple hundred women up their game when it comes to money.

(26:53 – 27:19)

One—you were transferred from—to basketball. What—what are some things that kind of drove you to the finance world?

Well, when we lost my dad, yeah, all the—all the funds went to my mom, who—she, right, completely depended on my dad for our finance. So she didn’t really know what to do or how to do or whatever. And we went to a trusted advisor, and you know, they just took a—took her to town, took us to town.

(27:20 – 27:44)

And right then and there, I figured that—you know what? Okay, I got this number, and I’m gonna figure this out. And so my mom did too, because she was like, “Well, if anyone’s gonna lose my money, I’m gonna, you know, not give it to somebody else and let them lose it.” Right. And so we dove into finances.

(27:45 – 28:12)

And by this time, you know, I didn’t do it in college as much. But when I went to Europe, you know, I started to make a little money and do some different things. And so I dove into the finance world and started to understand—you know, stocks, bonds, ETFs, mutual funds, options, different things like that. Options came later in my life.

(28:13 – 28:41)

Right. Importance of compounding and saving early, and you know, what different timelines mean in somebody’s financial life and how important they are. Yeah. So that’s really what spearheaded me to become very educated and knowledgeable in the financial world. It was like, okay, I’m gonna make sure I know—when I sit at the table with somebody and they start to speak to me about finances, they’re not speaking to the dumb blonde. Like, I know what’s going on.

(28:42 – 29:20)

And it’s so funny, as women, you know, it’s like—when you take your car to the shop, you know, they’re gonna try to take you to town because you’re a woman. Or when you’re dealing with a contractor, you know, that—it’s the same with money. It is. And it’s unfortunate, but it’s a real thing.

So I chuckle when people talk to me—like, when I was talking about my house, for instance, and you know, refinancing or recasting. You know, I was trying to figure out what I needed and wanted to do. And the guy, you know, he’s talking to me—down to me, you know, like I’m some dummy. And I just started laughing. I said, “You know, do you know what my profession is?” Then he went, “Oh.”

(29:21 – 29:43)

Yep. Yep. No, I don’t know—it was sports. Plus, I was the fourth daughter, so I learned how to—although I don’t do it anymore—but I knew how to change oil, all that stuff too. Wow, that’s awesome. That was back then. My mom taught me how to change tires, so I can change my tire. I did. I did that too. I did that too. But you won’t find me doing that now.

(29:44 – 30:12)

But anyway, but to your point—I mean, I actually have real estate. That’s one of the things that I understand. I don’t understand all those things you’re talking about, but real estate was one that I did, because it’s a business. I could write things off.

You know, I can write off depreciation, all those type of things. So I got educated on that, because I didn’t want to trade my time for money.

(30:13 – 30:43)

And again, you’re trading time for money in a lot of ways. But I’ve been guilty of having money set somewhere, not making interest. Well, that’s basically losing money, because there’s something called inflation, and you’re not keeping up.

So—and that’s—people don’t understand that.

And yeah, like what I was talking about—the power of compounding. Like, this is why the rate of return is so important when you’re talking about money. Because you’re absolutely right—if you were to take a dollar and bury it in Your backyard for 200 years — that dollar after 200 years would be actually a negative three cents. Is that right? Okay. Yes, that is okay, actually factual.

(31:00 – 31:34)

And so that just shows you how inflation eats up your money. And so — and what’s disappointing to me, and this is what also has really given me passion around the financial industry — is that, you know, they took away pensions. Now everybody has 401(k)s. They kind of — you go in there and nobody knows what to pick. They’ll go in a target fund or whatever. I have no idea what that is or what it means. And the government has given us the onus on our own retirement.

(31:34 – 31:58)

And so it’s important that we figure out what we’re doing. And if you don’t want to — which is fine, because a lot of people don’t have time, and they’re like, “You know, you’re crazy, I don’t have any time. I’ve got kids, got this job,” and that’s fine — but if you don’t, then at least go to a reputable person that will help you. Yes, because it is that important. It is.

(31:58 – 32:07)

I mean, really — I mean, your health and your health and your security for your family — you know, those are kind of top two.

(32:07 – 32:40)

And so you got to understand that and learn. I mean, things are changing. I mean, things are complicated. And right now, from my standpoint, look at the market — a little expensive on some things, I think. I mean — but maybe it’s just maybe write it out like you should on some things. Or do you do real estate? Or do you buy? I’m actually kind of interested in buying businesses, for example. I mean, I’m at — something local, businesses, small businesses that have revenue. So those are all different ways you can invest. You can invest in businesses, you can invest in property, you can let it — put in stock markets.

(32:40 – 32:56)

Important. All the other things are also important. Absolutely. The first vacation, actually, is important. Yeah.

(32:56 – 33:21)

And I think the most important thing, whether it be anything that you just spoke about — you know, real estate, businesses, the markets — you have to be knowledgeable. You do. You really do. Even, you know, in any of those. Because you can buy a really bad property in a really bad area and then you lose money, you know?

(33:21 – 33:40)

So these are really important things — that if you’re going to do this, if it sounds too good to be true, it probably is. And why — I mean, from my perspective, and I know I’ve been guilty of it — there’s people who have time to understand that. So you build and bring in partners, whether it’s your doctor or your physical therapist or whatever, who know how to do certain things — or your financial advisor.

(33:40 – 34:01)

I mean, I think they’re — like you said, we’re all busy. You actually will probably make more money and save time by getting in — partnering with people who actually understand it. And time is actually money. It is. You think about time as money — it really is.

(34:01 – 34:29)

Time — it’s more than money. It is more than money because you can’t earn more time. When your time is up, your time is up. And man, that’s such a good point. And I’ve been guilty of it. I mean, I had gone on some of those properties — I was painting them and, you know, doing all those things, fixing them up. And I probably could have made that list — that time — to do some of that stuff. But no.

(34:29 – 34:47)

Time is — time is — I mean, we only have one time. That’s right. Now. I have one time. And these funds will make it a lot better for your experiences, so you can have experiences, so you can hang out with friends and over dinner. Or you can go take a trip out west or whatever you want to do.

(34:52 – 35:25)

…but it’s it it builds a higher quality of life when you actually understand money. Like, and one thing you know, because money is — does not make happiness, does not necessary — it doesn’t bring happiness, it really doesn’t. That’s an n-word thing that you’ll have to figure out on your own, but it does make your life so much easier. It does, it does. I think there’s — I don’t have any studies in front of me — but I think there is a baseline number on that, on that, those financial pieces.

(35:25 – 36:00)

But it does. It makes your life easier. You can do things, and whether pay your kids — for kids’ college, or take a trip so that you’ll never forget it, or, you know, not worry about food on, you know, just lots of things — it makes a lot easier. And it also gives you — we talked about this a little — from my standpoint why I love what you’re doing and I love educating, especially — I don’t mean to be — women, because we know that that’s kind of an area that we need to work on. And as a society, influence — it gives influence. It builds, it gives, and it gives. Also, I’m donating to a nonprofit. I get to do that because now that I have those those things, and so you’re able to help me too.

(36:00 – 36:41)

So I, I, I think it’s important for us to really step back and have the discipline like you had as a basketball player, but also as a discipline from, you know, individuals to think about money and have a mindset around it. Well, one of the things — and I’ll talk about this a little bit in the, in the retreat for women, and I’ll just touch on it because I know this isn’t just a, you know, a women’s forum — but the reason why it’s so important that women know, and, and you’re — and as husbands, you want — you should want your wife to know, because you know women that are over 65 have a 55% chance of being a widow.

(36:41 – 37:21)

Wow. You know what I mean? Think about that for a minute. So you know, women live longer than men by seven years on average. Yeah. And so to keep them in the dark is not very good for you or your family or any — I don’t think that’s what you really want to do. And so that’s why it’s important. And then if you aren’t married or have a different type of relationship, you know, women make 82 cents on the dollar. It might go down lower here pretty soon, we don’t know, but that’s, that’s a true thing. And so this is why I think it’s so important for women. But women tend to hand off this to men.

(37:21 – 37:58)

They do. And I have — I’m always learning too, like you are. I mean, I am — I own a business, but I’m still understanding how can I improve my profit margins? How can I, you know, do these types of things? You’re always learning, and you, and you need to learn. And things change too in the marketplace. So I think, you know, it’s something that everybody needs to have a discipline on — whether it’s monthly, quarterly, or also meeting with somebody like yourself so they know what they’re focusing on and what they need to be doing.

(37:58 – 38:40)

What are they missing? What do they need to be doing? What are some new habits that they should have in place? And I think both of us have this — we talked about our dads passing away. I think you had somebody who unfortunately took advantage of your mom. My sister and her husband moved in with my, my mom to try to get it all together because she didn’t know it either. Right? It’s a real — it’s a real issue. Things have changed. I still think a lot of women still couldn’t put their financial statement and know what it says. And it’s so important. It really is so important.

(38:40 – 39:18)

But you’d be surprised too — even men. I’m like, I don’t just say — because I meet with a lot of different people. And you know, even, even if, if it’s not your cup of tea — if real estate’s your cup of tea, that’s fine. But if you’re working somewhere and you have a 401(k), or you know, something like that, you know — or one — figure out the difference between a traditional IRA and a Roth. Figure out, you know, some of the things that you’re invested in. And it is going to be smart to know the difference between stocks and bonds and these.

(39:18 – 40:07)

You’d be surprised how many people I meet with that don’t know these things that are just very basic — that whether you have an advisor or not, right, you need to know them because you — it’s your money. And nobody cares more about your money than you. That’s right. And you should know them. And back to — I, I feel like I’m — I have a financial statement, and I know what’s on it. But I also know there are a lot of things that I don’t know. I mean, I guess I know real estate, and I have a small business, and I’m working on growing that small business. But I really don’t know much about stocks. I really don’t know. I know what they are — I mean, I have them — but it would be good to understand them or work with somebody to say, okay, maybe I should do this instead of this.

(40:07 – 41:04)

You know, because you don’t know what you don’t know. And it’s — it can be complicated out there a little bit. It is complicated. It’s not easy. There is so much information in the financial world, truly. And, you know, I don’t think that the governing bodies help by making it simpler for us either, you know, which is unfortunate, but it’s true. You know, kind of like the IRS — you know, your taxes — you know, everyone’s looking at this going, what in the world? You know, you’re trying to do your own, and you’re like, nope, I have an accountant. Well, there you go. But it’s a similar thing, you know. It is.

(41:04 – 42:00)

So this is where it’s really good and important to have good people around you. It is. People you can trust, like we just talked about. Yeah. And then you can have honest conversations and learn. I mean, there’s all things that come in to do that. I don’t know — I mean, Bitcoin, FTEs — yeah, no clue. It’s a cryptocurrency. Highly speculative. You know, it’s highly speculative. That’s, that’s something to invest in if you’ve got extra money that you don’t mind losing, because it might, it might quadruple. It might not. It might — you might lose it all. It’s like going to Vegas. Yeah, you don’t really, you don’t really know. So, you know — and there’s nothing, you know, to substantiate it at this point either beside, you know, what we’re gonna do in our government.

(42:00 – 42:39)

So yeah. Yep. We’ll see. We’ll see. We’ll see. We go down that road. Yeah. Do I know — you also worked with a lot of young athletes. What do you think about empowering the next generation — both athletes and then young people — getting them thinking?

Very important. I mean, as far as — you know, I still do a lot of speaking events. And I do it for sports teams and different thing, and then for finance as well. So I kind of go both ways. It’s, it’s very important to, to empower. That was the reason why I coach — is because I really wanted to empower young women, and to let them know that it’s okay to lead.

(42:39 – 43:19)

It’s okay if you’re a woman and you lead. It’s okay that you have a voice. It’s okay that you’re strong and in your convictions, you know. It’s okay. Thank you.Because we’re taught that it’s not. Yeah. And that’s where the passion comes for me. And so that’s where it came from — basketball — and kind of empowering them and letting them, you know, take the reins and show them — yeah, this is what you do. This is how you do it. And look what can happen. And it can be a beautiful thing.

(43:19 – 43:35)

You know, it’s the same with finances too. You know, if you start to save at this age — imagine if, you know, if you have, if you have your, your summer job from college, and you save, you know, $500 in the summer, and you invest that and you let that compound, and every summer you add to it — you know, by the time you retire, you’re gonna be a millionaire.

(43:35 – 43:56)

Yeah, which you’re gonna need to be to retire, which you, you will buy that for sure, or you’ll—yeah—or it won’t be, or it won’t be good. And it’s also a balancing act too, of what you save and then be being strategic of living today well.

(43:56 – 44:16)

This is, this is the one of the biggest and crucial—most crucial—things that people don’t understand, because they always come to you like, “How much do I need? What do I need to—how much do I need to retire? You know, what am I gonna need?” Well, the biggest question you have to figure out is: how much do you spend? Marinate on that for a minute.

(44:16 – 44:38)

Like, so that means that everybody’s number is different. If I spend $200,000 a year, a million dollars isn’t gonna be enough for me to retire at 60. Not even close, right? But if I’m spending $50,000 or $60,000 a year—well, you know, now we’re talking now, right? Now we’re in a ballpark. So, like, these things people don’t understand.

(44:38 – 45:01)

Yeah, and where you spend your money—I mean, I don’t eat out a lot because I prefer to eat, and I eat healthier too that way. But then I’ll travel. I mean, so you just, you just, you just got to pick what you want to do. Unless—I mean, I’m not, you know, a billionaire, not even close, or, you know, a multi-millionaire. And, you know, I have goals to do that, Vicki, but I’m not.

(45:01 – 45:31)

But you gotta start somewhere, and then you gotta—it’s just like sport or anything else—you have to start somewhere. And every step is along the way, and you have to have a game plan. Like, I would never walk into a game without a game plan. And I knew what I was gonna do. I had, I had, I had an A, B, and C answer. So I always, I always wanted to be prepared. And it’s the same in life. It is. It is.

(45:31 – 45:56)

And that’s the, that’s the really the, the transition to what you’ve made—from player, coach, financial leader. So that makes a whole lot of sense. I mean, you have to have a game plan. Yeah, have to have a—life in life and in business. And, and, and, and it’s also more rewarding if you do.

(45:56 – 46:14)

I mean, if you don’t have a playbook, you know, you’re gonna go from the hip. You’re not gonna win that game. Well, you might, but then you’re gonna do it again, and you probably won’t. And then, and then you won’t even have a recipe to figure out how to do it again if you do succeed.

(46:14 – 46:27)

That’s right. Any other—you know, I really appreciate you—any, any other passing thoughts that you, you wanna, on this Proof Point podcast?

(46:27 – 47:00)

You know, I guess just—it kind of goes back to what we said in the beginning. I think it’s like your outlook. And just please try to have a positive outlook and be grateful. And, you know, life throws you some lemons that really—I’ve had, I’ve had my share of lemons like everybody else. And know that everybody—regardless—everybody’s has stuff going on in their life that we don’t know about. So have some kindness and some empathy and be grateful. Don’t be looking at what they have and comparing yourself. Be grateful for what you have.

(47:00 – 47:38)

I love that. I love that. Go, go Texas. And, I mean, going into Final Four here—this might be after—we’ll see who, this might be live after those games. But—and South Carolina and Connecticut and UCLA, right? Those are the four? Yeah, great women’s teams, great programs, great coaches. Oh, very close. I really have a lot of respect for her. She does a tremendous job with her programs. And really, we actually played against her back in the day when I was with Toledo—took ’em to the wire. And she just, she’s an amazing coach.

(47:38 – 48:04)

And so, a lot of fun. And I just—you know, everybody look—yep, we did definitely do well. Thanks, Vicki. We’ve been talking to Vicki Hall with CH Douglas and Gray Wealth Management, former NBA, WNBA star and coach. Vicki, thanks for doing the Proof Point podcast.

(48:04 – 48:14)

Thank you. Thanks for listening to the Proof Point podcast. We’ll see you again next time. And be sure to click subscribe to get future episodes.